Why 2025 could be a turning point for E-Commerce (and how to prepare)

After a few tough years of economic uncertainty and erratic consumer behaviour, 2025 could finally bring e-commerce businesses some breathing room, and even opportunities for real growth. That’s the sentiment emerging from the latest eCommerce Growth Report 2025 by IMRG and Shopify, which surveyed over 130 retailers across the UK. But this cautious optimism comes with caveats: growth won’t be handed out freely. It’ll go to the businesses who know where to invest and what to fix.

Short on time? Here are the headlines

Retailers are optimistic: Over 70% feel more positive about customer demand heading into 2025.

Customer acquisition is still the biggest hurdle: Despite the positive outlook, 37% of retailers say winning and keeping customers is their top challenge.

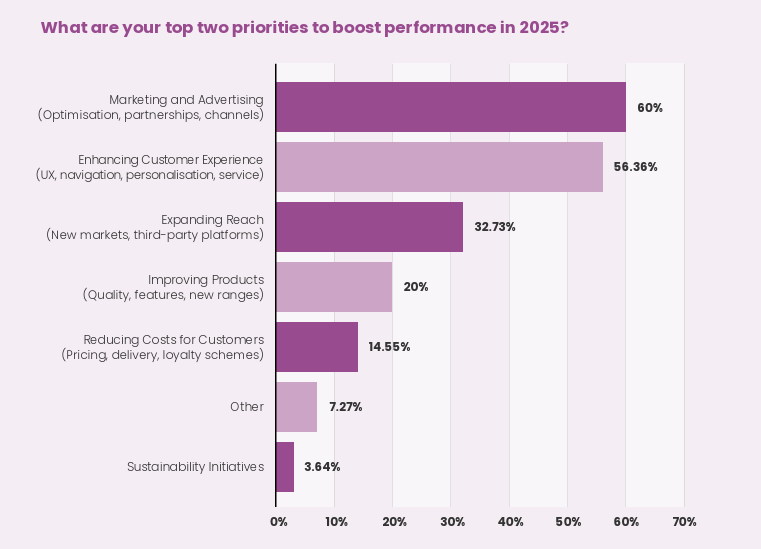

Marketing and experience lead investment: 60% are prioritising marketing, while 56% are improving customer experience. This is pointing to a clear focus on both reach and retention.

Social commerce is gaining traction: With 24% of retailers betting on social media as a growth driver, influencer partnerships and platform-specific strategies are now critical, especially on TikTok and Instagram.

Fast, frictionless checkouts matter: 58% of retailers are working to speed up checkout flows, recognising its impact on conversion and basket abandonment rates.

Expansion is on the radar: Over half of retailers are planning—or considering—entry into new markets, signalling a strategic shift toward global growth.

Personalisation is a top Black Friday focus: Nearly 30% will lean on tailored offers and marketing, supported by first-party data and AI tools.

Let’s dive into the detail

Confidence is growing, but let’s keep our feet on the ground

There’s a noticeable shift in sentiment among retailers heading into 2025—over 70% feel more positive about customer demand, and not a single respondent reported feeling less optimistic.

Source: IMRG Christmas Connect event poll, 38 respondents, 12th December 2024

From my perspective, this isn’t just hopeful talk. It aligns with what we’re seeing in the numbers: after years of volatility, the market finally turned a corner in late 2024, with IMRG recording a +4.1% YoY rise in September and +6.4% in December. That’s the kind of consistency we haven’t seen since before 2021.

But let’s not mistake optimism for stability. In my experience, the biggest test for e-commerce in 2025 isn’t whether demand exists, it’s whether we can capture and hold attention in an oversaturated market. The fact that “customer acquisition and retention” is ranked as the top challenge (37%) reinforces that. It's not just about getting clicks anymore, it’s about building trust and value fast, and holding on to that customer relationship before it slips.

Marketing and CX: The investment priorities that actually make sense

Seeing 60% of retailers prioritise marketing and advertising doesn’t surprise me, it’s the logical play when acquisition is under pressure and market is fierce. What is encouraging is how close behind customer experience sits, with 56.36% focusing on UX improvements and personalisation. To me, this shows we’re finally acknowledging that it’s not enough to drive traffic; you’ve got to earn every conversion.

Source: IMRG Webinar poll, 55 respondents, 19th December 2024

I’ve also noticed that more brands are blending brand-building with performance marketing. Social commerce is a great example of this. With nearly 24% of retailers calling it their top growth driver, it’s clear that platforms like TikTok and Instagram are no longer experimental, they’re central to marketing strategies.

In beauty and fashion, I’ve seen brands scale quickly through micro-influencers and authentic User Generated Content (UGC). TikTok might feel noisy, but it’s where younger customers are deciding what to buy and who to buy it from.

Checkout isn’t just a UX issue, it’s a revenue issue

When I talk with peers in the industry, checkout is consistently flagged as a pain point, and this IMRG stats back that up. 154 seconds (2.5 mins) is the average time to complete checkout for those who do convert, but when that’s cut to 125 seconds (2.08 mins) on single-page checkouts, the difference in performance is tangible.

That’s why it is positive to see 57.5% of retailers actively working on streamlining the checkout process. From my experience, simplifying the checkout journey for customers has directly impacted conversion. Whether it is through guest checkout, fewer steps, payment integrations or mobile-optimised design, the small tweaks add up. And with options like Buy Now Pay Later becoming hygiene factors, not perks, expanding payment choices is no longer optional, it’s expected.

International growth: High potential, high stakes

Over half of retailers are eyeing new markets in 2025, and that lines up with what I’ve been hearing from larger DTC and mid-market brand employees. But international expansion is rarely plug-and-play. From my experience, brands underestimate the operational lift involved in doing this. Everything from compliance to currency to shipping needs proper planning and consideration.

It’s not about translating your website and crossing your fingers. Localisation isn’t a checkbox; it’s a strategy. For markets like Germany, the Netherlands, or even parts of Asia, if you're not tailoring the customer journey, including payment preferences and customer support, you’re setting yourself up for friction and missed expectations.

If this is an avenue you’re looking to be sure, its important to get the right advice and experience before making that leap.

Personalisation: Powerful when done right (and rarely done right)

Finally, personalisation is rightly taking centre stage. Nearly 30% of retailers are making it the backbone of their Black Friday 2025 strategy. I fully support this notion, because when personaliation is executed well, it drives conversions and loyalty. But in practice, it’s messy. Most marketing teams I know are juggling a patchwork of tools, spreadsheets (!) and data silos making it hard to deliver a seamless, real-time experience.

The move toward first-party data and AI-driven recommendations is the way forward, but we’ve got to simplify the tech stack. If your personalisation relies on ten different platforms pulling in ten types of data, you're not personalising, you’re patching. And you’re giving your employees a head with lots of scope for error.

The key for 2025 will be doing fewer things, but doing them smarter.

Final thoughts

2025 is shaping up to be a year of opportunity, but only for those who are ready to act. The optimism we’re seeing in the data provided by the IMRG and Shopify is encouraging, but growth won’t come from wishful thinking. It’ll come from doing the hard things well: tightening up acquisition strategies, investing in meaningful customer experiences, and getting serious about performance at every touchpoint, from first click to checkout.

We can’t keep throwing our budgets at the same old playbook and expecting different results. The brands that will win this year are the ones that personalise with intent, simplify their tech stacks, and expand smartly, not just widely.

My advice? Pick one area. CX, checkout, social, or market expansion, and then go deep. Be creative. Test. Measure. Improve. Then scale what is working. That’s how we move from cautious optimism to real growth.

If you’re looking for where to focus next, start with your data. Where are people dropping off? Where are you leaving money on the table? Use that as your roadmap beginning, and build from there.

If you want to download the full report, head over to the IMRG.